On This Page

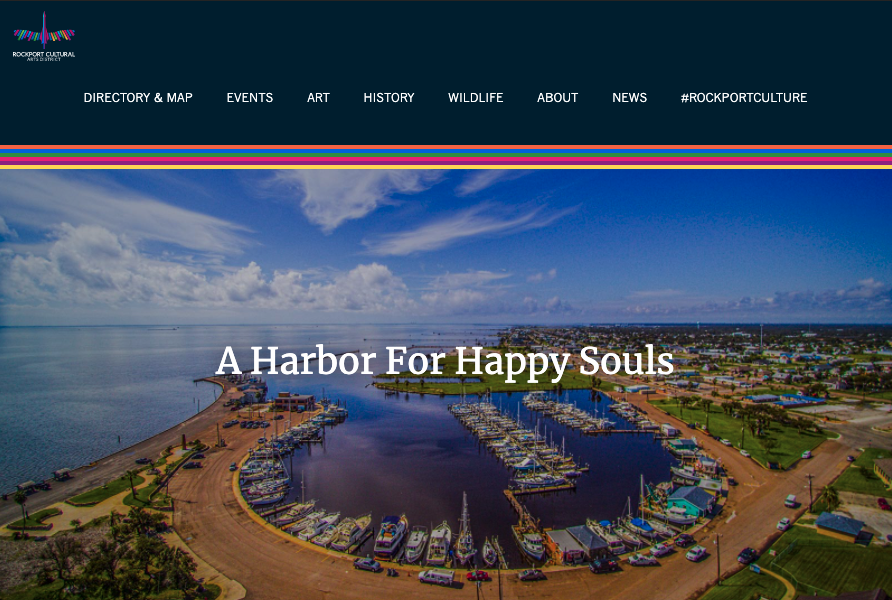

Rockport, TX

Rockport Cultural Arts District: Rockport’s shifted its economic trajectory by defining a downtown cultural arts district which features a unique blend of (1) historical architecture and unique built form leftover from its legacy as a 19th century port and railroad hub and (2) a cluster of eclectic art galleries, bars and transplanted resident retirees.

College Station, TX

Within their Comprehensive Plan 2021, the City sets the framework to enhance local vitality, stability and sustainability for places of distinction. The plan strives to identify, create, conserve, and connect those areas that make College Station unique and contribute to the City’s character and sense of place.

Buffalo, NY

Buffalo’s Queen City Pop-Up Program: To encourage retail activity along Main Street, the City, urban development corporation and real estate community coordinated a grant program for applicants to set up pop-up retail establishments in prime vacant store fronts of the city’s Theater District.

Richardson, TX

The Richardson Department of Health maintains a robust set of requirements and ordinances dedicated to mobile food vendors that are clear, targeted, accessible to operators, and low-cost to maintain. Their Mobile Food Vendor permit holders list includes 32 diverse concepts with multiple enterprises having added or converted to brick-and-mortar locations in the city’s commercial corridors.

Texas City, TX

Starting in 2016, the City of Texas City launched the Stay Classy Texas City Beautification Award program for small business beautification projects ranging from façade improvements to landscaping and signage upgrades. The program was meant as both a way to provide needed improvements but also as a token of gratitude to local businesses for their meaningful contributions to the local economy.

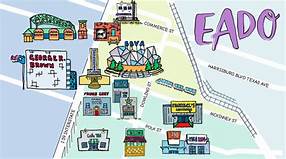

East End - Houston, TX

As a result of the Livable Centers study conducted in 2009, a key catalytic project from the East End Management District’s efforts is the Navigation Esplanade, which boasts weekend markets with solar powered booths and year-round festivals.

Main Street - Houston, TX

In 2017, the City of Houston formed the Walkable Places Committee to place pedestrians at the leading edge of developer’s design considerations at key sites and locations. Main Street between Dallas and Lamar Streets bars all auto traffic to create a passenger- and pedestrian-only zone in the right of way along the north-south METRO Rail line.

Westchase - Houston, TX

The Westchase Livable Centers study and the Westchase Bike/Ped Master Plan target the Westheimer area for the creation of a pedestrian promenade that is positioned as a “front yard for mixed-use development.” Recent efforts have focused on adding both pedestrian amenities and WIFI hotspots for employees of area businesses and students enrolled in workforce development programs in adjacent buildings.

Amid the Covid-19 pandemic this corridor was explored as a strategic asset to enable coursework and meetings to take place outdoors, allowing for social distancing.

Norfolk, VA

Downtown Norfolk has built a host of amenities along their waterfront, connecting downtown retail, arts, and nightlife experiences with pedestrian accessible parks, trails, and festival destinations. For example, the Elizabeth River Trail is a 10.5-mile urban pedestrian and bike trail along the Norfolk waterfront, maintained and marketed by the Friends of the Elizabeth River Trail Foundation with support from the City of Norfolk.

San Diego, CA

To maximize currently underutilized streets in downtown San Diego, the City is constructing six pedestrian-only promenades. In mid-2020 construction began on the “14th Street Promenade,” which will run for 11 blocks and be landscaped with lighting, trees, and outdoor furniture. The promenades are part of the Downtown San Diego Mobility Plan, which was approved by the City Council in 2016.

Arlington, TX

Arlington implemented a vacant land and building registration ordinance to monitor, inspect and record long term vacancy. They use this data for vacant structures maintenance planning.

Houston, TX

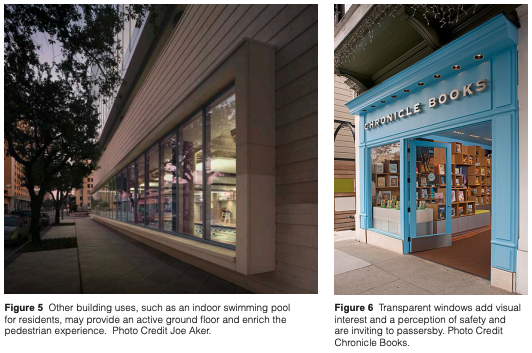

The Houston Downtown Management District released design guidelines to promote a walkable neighborhood on the east side of Downtown. The design guide specifies active ground floor uses—including retail, public spaces, fitness facilities, day care centers and more—in addition to ground floor design to encourage well-lit, street-oriented entrances.

Redwood City, CA

Redwood City simplified their code and introduced active use requirements in downtown and conditional active use in surrounding areas.

Oakland, CA

Oakland collects an annual vacant property tax when a building is in use less than 50 days per calendar year. Taxes range from $3,000 to $6,000 and are not subject to exemption.

Houston, TX

The Greater East End Management District implements an award-winning graffiti abatement and litter removal and beautification program throughout their district and on contract for other districts.

Kansas City, KA

Kansas City manages a graffiti removal program within the Crossroads Arts District through contributions from local businesses. The campaign is a precursor to the establishment of a business improvement district.

San Antonio, TX

The City of San Antonio wayfinding system is integrated into the city’s Unified Development Code (UDC) but has a separate policy document for ease of use. It articulates acceptable and prohibited design standards for all exterior signage across the city and includes acceptable types for awnings, wall-mounted or freestanding signs. The program is strongly tied to the city’s focus on historic preservation as a driver of economic development through cohesive, consistent community character.

Georgetown, TX

The City of Georgetown designed a coordinated system of wayfinding and public signage to get vehicles and pedestrians to and around downtown. They identified the need for a city-wide system of signs due to rapid population and geographic growth of the City, and the corresponding development of many new public amenities

Lincoln, MA

Lincoln wayfinding orients many visitors to their nationally historic sites of interest, and helps to promote an area business who fabricated the entire signage system.

Sealy, TX

Sealy has a long-standing commitment to high-quality visual standards for public roadways and spaces. At a minimum, cities must have a strictly regulated and enforced sign code, a ban on new billboards, and a landscaping and tree planting program. Sealy was commended for its Downtown District Ordinance that controls downtown aesthetic elements and facades of buildings and has been recognized as a Certified Scenic City by Scenic Texas.

El Campo, TX

El Campo has a design manual for all infrastructure, including but not limited to street crossings; street lighting; utility locations; curbs and gutters; and design requirements for roadside ditches. In 2016, El Campo was recognized as a Certified Scenic City by Scenic Texas.

Amarillo, TX

The City of Amarillo provides matching grants of up to $3,000 to advance the creation of public art in five geographic areas across the city, including the Central Business District. According to city officials, the program has many benefits ranging from enhancing community appeal, promoting civic pride, adding jobs in the arts, and creating awareness of the importance arts and culture to the community.

Houston, TX

The City of Houston manages both the Civic Art Program and the Traffic Signal Control Cabinet (TSCC) Art Program. Through the Civic Art program, a range of permanent and temporary art projects on public facilities ranging from murals on public buildings to artistic wraps on public fleet vehicles. The TSCC leverages an often-neglected piece of public utility equipment that is present at every signaled intersection. The program is overseen by the Office of the Mayor in coordination with Public Works & Engineering.

Seabrook, TX

Seabrook’s Pelican Path is home to more than 43 larger-than-life painted pelicans that give the city character and attract tourists. The Seabrook Merchant and Tourist Association worked with local artists to deploy pelicans around the city—some are whimsical, others celebrate Seabrook as a bird sanctuary, and some represent regional attractions, like NASA. Some pelicans were sponsored by local businesses.

Elgin, TX

For over 30 years the City of Elgin has proudly and creatively promoted its status as the Sausage Capital of Texas in hosting the annual Hogeye Festival on their historic Main Street. Hogeye is a family and community-oriented event featuring all things swine. The festival has grown to a multi-day event featuring charity art auctions, BBQ cook-off, Queen Sowpreme and King Hog contests, Cow Patty Bingo and more. The event draws thousands every year and proceeds also go to supporting local businesses in Downtown Elgin.

Austin, TX

The City of Austin hosts major events within primary downtown corridors of Congress Avenue and 6th Street nearly 40% of weekend days of the year. The Pecan Street Festival is one of the longest-running arts/crafts and music festivals in the country. Shops and artisan dealers are placed within the center of the right-of-way so that pedestrians can still access frontages of existing stores, bars and restaurants. Initially designed to promote historic preservation, the Pecan Street has grown and expanded to be a major fundraising event for dozens of area arts, culture, music and historical non-profits.

Victoria, TX

Victoria, TX Preservation Incentive Program: Façade improvements and other grants for relevant forms of preservation are open to owner-occupied or tenant-occupied sites in one of Victoria’s five Historic Districts. Sites are not required to be a state or nationally registered historic site, but must articulate their connection and place in Victoria’s history. Additionally, any demolition permits within the historic districts require a 60 day delay to allow for any possible community appeals.

Bonham, TX

Downtown Bonham "Save Our Structures" Program: The City of Bonham and the Bonham EDC jointly provide grant funds to businesses or owners to engage with design professionals and assess essential structural and aesthetic improvements to get buildings up to code standards.

Victoria, TX

The City of Victoria site development code states that for all private lots applying for development permits, 10% of site area must be dedicated to curb-bound landscaping for the purposes of visual appeal, noise abatement, to improve property values and to reduce the heat island effect and improve energy efficiency of nearby structures. Locations of landscaping are also recommended to be concentrated along street frontage, also known as Street Yards.

Lenexa, KS

The City of Lenexa has won national awards for its stormwater management planning, including the Rain to Recreation program. The city’s approach focuses on a community-driven vision with multiple living documents and adaptive plans to continually improve projects and programs for the benefit of area water resources—ultimately the community’s streams and watersheds drive and guide the city’s Land Disturbance Ordinance which includes water body-based setback requirements and pollution regulations.

Millcreek Township, PA

Millcreek requires that all new parking lots in the city to include 7% vegetation coverage, mandatory for all lots with more than 15 spaces. The ordinance is designed to increase pervious surfaces to increase groundwater recharge while also mitigating runoff and enhancing the built environment.

New Braunfels, TX

The City of New Braunfels does not require any building setback for non-residential buildings. Allowing a building or shop frontage to be located on the property line allows for an engaging, pedestrian-scale environment amenable to a neighborhood business district or live-work-play corridor.

San Marcos, TX

San Marcos adjusts building setbacks for each of its six character districts. The most urban districts (CD-5 and CD-5D) allow for 0’ to 15’ lot line setbacks from the lot line.

Conroe, TX

The City of Conroe identified a smart code as a necessary component to allow for a balanced growth pattern that accommodates various styles and densities depending on the development contacts. The municipal code allows for a range of lots sizes for unit types ranging from standard subdivisions, to estate homes, to more urban types such as townhomes or duplexes.

Houston, TX

In 1999, the City of Houston reduced minimum lot size from 5,000 square feet to 1,400 square feet to diversify housing stock making it easier to redevelop or subdivide existing parcels. Special Minimum Lot Size by Block can be established by individual neighborhoods to preserve lot size and prevent further subdividing, if warranted.

Victoria, TX

Victoria, Texas Historic Districts: In the Central Business District of historic Victoria, the City removed all parking requirements to promote increased density and to support the continued use of existing higher density development. The City exempts properties in the Downtown Business District from all parking requirements in Sec. 21-92 of their City Code.

Sealy, TX

In their Downtown District Ordinance, Sealy exempts the downtown area from parking space requirements that apply to commercial, institutional, governmental, and industrial establishments within the city. This allows for more flexibility for business owners and encourages a more walkable downtown.

Pearland, TX

Pearland’s zoning code includes four zoned mixed-use districts—some of which also feature sub-districts—defined by their respective character, concentrations of uses, density, or degrees of pedestrian-orientation.

Galveston, TX

As a result of a Livable Center’s study recommendation, Galveston created a "Central Business" zone which allows for residential and non-residential uses, discourages industrial uses, and has no off-street parking requirement allowing for greater flexibility in development.

Fulshear, TX

Fulshear’s Livable Center study (completed in 2018) resulted in a downtown zoning typology designed to cultivate a vibrant, walkable, mixed-use community with richly-programmed public and private spaces. The downtown zone was such a strong fit for the community that in April 2020 an area developer of a 125-acre property near the historic downtown opted for and received approval for a zoning change from rural residential to downtown district.

Texas City, TX

Texas City rezoned 6th Street as a Revitalization District in order to further the goal of developing this historic street into a regional entertainment destination. New streets and sidewalks, vintage-style light posts, esplanades, trees, unique signage and awnings all add to the pre-1950s charm envisioned for the area.

Bastrop, TX

Bastrop adopted the Bastrop Building Block (or B3) Code as a flexible land-use policy that will allow for growth to be steered to sustainable investments, pay for aging infrastructure, and limited outdated development patterns that do not serve the local population. It carries the cities’ historic block and lot structure forward as the template for future development to reflect its history as a walkable, vibrant moderate-density core.

Bryan, TX

The City of Bryan initiated an innovative code concept known as pattern zoning which codified allowable developments based on their location along the South College Avenue and College Main corridors. Five different development districts are designated as focused planning areas which “incorporate physical, cultural and social realms to align and advance a desired way of living, working and playing while clearly distinguishing the unique personality of an area.” Existing property uses are not required to meet new code requirements unless a new development or redevelopment concept is pursued

League City, TX

The City of League City established a Form-Based Code in 2017 to "implement the vision” of the League City Livable Centers study and incorporate the City’s historic “Old Towne” feel. In Section 3.9 of the City’s zoning regulations, building scale, building form and location, pedestrian orientation, vehicle accommodation, and open space and landscaping are all prescribed for the designated Old Towne area.

Round Rock, TX

Round Rock Code of Ordinances Article VIII Sec 2-91(t) live/work units are permitted in downtown mixed-use areas, subject to some conditions. The occupant must operate the business or trade, but the unit may have non-resident employees.

San Marcos, TX

San Marcos permits live/work units built as one- and two-family dwellings or townhouses in three of the city’s six designated character districts which are designed based on a spectrum of low to high density. Live-work by right allows for a more entrepreneurial base of residents and businesses. [

Bozeman, MT

Bozeman, with a population of just over 45,000, has been championing a pro-artisan zoning framework since allowing artisan manufacturing to take hold in retail areas like downtown in 2014. As part of the addition, producers must work in an enclosed space, can’t hold storage outdoors, or expand beyond 3,500 square feet. The new framework was meant to assist those who create goods with hand tools or “small-scale, light mechanical equipment,” and now permits these producers to work in dense areas like downtown. This change is rooted in the city’s 2009 economic development plan, which designated manufacturing as one axis to create mid- to high-wage jobs and spur more diversity among the community and its businesses.

Bloomington, ID

Bloomington utilizes a robust set of mixed-use zoning categories aimed at both increasing investment, leveraging public investment, and enhancing community character including the Showers Technology Downtown Character Overlay. Standards for the area complement the mass and scale of existing historic structures, draw upon neo-traditional design concepts to extend the street grid and to create publicly accessible open space, integrate development that is strategically planned to promote mixed-use development focused on light industrial, manufacturing, and office uses where live/work, young professional, single-family, empty nester and retiree housing markets are targeted.

Bryan, TX

The City of Bryan offers Fast Track permitting for eligible economic development process which involves: assignment of an economic developer liaison to serve as your primary point of contact, maximum 20-day permitting, concurrent reviews and the ability to call special meetings of Planning & Zoning Commissions or other applicable boards.

Richardson, TX

The City of Richardson’s Building Inspection Department offers 3-day plan review for small business owners.

Hitchcock, TX

Hitchcock provides a concierge service for permitting, inspections and building services to facilitate a more predictable experience for businesses within and seeking their community.

Houston, TX

Fifth Ward Community Revitalization Corporation acquired the historic St. Elizabth Hospital and are leading the building through remediation and renovation of the building. This investment will position the property for adaptive reuse and adding much needed new and affordable housing units for local residents while also revitalizing a vacant and historically significant building.

Bryan, TX

The city can also grant publicly owned land free of charge or sold at a reduced price (such as the base price to recover cost of liens and taxes owed) to economic development projects. This incentive is negotiable and determined by economic impact and/or the project’s position as a catalyst.

Waco, TX

The Magnolia Market at the Silos in Waco was a highly success privately adaptive reuse project in the heart of the city which quickly became the community’s top tourist attraction and destination shopping center. Building upon this successful private development, the city’s downtown TIF has now committed $1.1 million toward the infrastructure improvements needed for an expansion of the development into two neighboring blocks which involve repurposing of several other pre-existing structures including the Second Presbyterian Church building as the anchor for the new site.

Houston, TX

The Houston Downtown Livable Centers Study (completed in 2009) identified the East Downtown district as a target for an adaptive-reuse approach for a new commercial corridor due to the presence of many large-format, short lot-line forms of the existing industrial buildings. The buildings were also concentrated along key corridors within walking distance to the Central Business District, sports arenas, and a major convention center. Using the Study as a roadmap, the East Downtown TIF district invested in major infrastructure upgrades and a pedestrian promenade to build a connective backbone to drive private investment and worked with the commercial real estate community on innovative financing tools that would preserve the culture and feel of then industrial character district.

Palacious, TX

The City by the Sea Museum in Palacios, TX is housed in building built in 1910 with a long history as a venue for traveling entertainers, a bar during World War II, a flooring shop, a Montgomery Ward, and a gift shop. Upstairs the building was used for doctor and dentist offices, a canning program during the Depression, and apartments for construction workers. In 2006 the Palacios Area Historical Association began renovations, and the museum was reopened to the public on July 3, 2009 as part of the city’s centennial celebration.

Texas City, TX

Investor and local business owners in Texas City acquired and over the course of a year-long renovation converted a long-vacant hotel into boutique urban offices. The concept started prior to Covid-19 pandemic but has opened up to much success given the need for office spaces closer to people’s homes.

Dallas, TX

Dallas Farmers Market TIF District: The Farmers Market District TIF plan was created to revitalize a large downtown parcel adjacent to the farmers market warehouses in Downtown Dallas. The TIF district has incited the reinvestment in the market building as well as surrounding warehouses into culinary incubators, housing, offices and other mixed-use concepts that have supported and added to revitalization efforts both within the district, as well.

Waco, TX

Waco utilizes TIF Districts as an incentive tool to steer development and site improvements in 3 blighted revitalization corridors. The TIF investments have focused on stimulated multi-model connections along the Bosque and Brazos Rivers to promote and target specifically mixed-use development. The TIF funds have gone to support expansions of the Magnolia Market and retail spaces, a schoolhouse conversion to loft apartments, and entertainment venues, among others.

Houston, TX

TIRZ 15 (East Downtown) was formed by the City of Houston to serve as the primary financial mechanism for revitalizing the aging industrial, warehousing and logistics facilities of East Downtown. Using the tool to capture the increment value increases resulting from adaptive reuse projects, redeveloped vacant parcels, and the BBVA soccer stadium investment, the management district has been able to upgrade roadways and public utilities befitting a high-density urban neighborhood proximate to the Central Business District as a way to capture additional investment.

Tomball, TX

Tomball entered into a 380 agreement with Baker Katz to renovate a vacant shopping center. In 2012, the city earned around $150,000 in annual sales tax revenue from the shopping center; Katz projected that the annual sales tax will increase by an average of $383,000 per year from 2013–2025—the period that the 380 Agreement will last.

Jersey Village, TX

Jersey Village entered into a 380 agreement with Collaborate, a Houston-based development firm, to build Village Center. Village Center will be a hub of communal space including restaurants, retail shops, multifamily housing, a hotel, flexible learning and workspaces, and City Hall on a municipal town square.

McKinney, TX

The City of McKinney leverages 380 agreements as the primary mechanism for granting tax abatements through refunds directly from the city’s general fund. In 2014, the city executed a 380 agreement with a medical supply manufacturer that involved an annual ad valorem tax rebates of 50% on all property improvements.

New Braunfels, TX

Under the City of New Braunfels Chapter 380 economic development program, the City is not obliged to offer incentives but, in some cases, may extend incentives should the project demonstrate a revenue gap to support the projects debt service in a standard financing scenario or if the marginal rate of return is below market rate. To be eligible the project must also meet minimum requirements such as: projected increased taxable value of $10,000,000 for the city or $420,000 for the Downtown; demonstrate sales tax revenue generation in the top quartile of the city’s top 100 sales tax generators.

Houston, TX

The Downtown Living Initiative Chapter 380 Program in Houston provides incentives for new multi-family residential and mixed-use development. Incentivizing housing downtown helps make the Central Business District a more ‘24 hour’ place.

Brazos County, TX

Brazos County executed a 381 agreement with global communications company Viasat for the expansion of their regional presence through renovation and capital investment in a new, expanded corporate campus. The agreement stipulated a term for achieving both jobs and salary performance metrics.

Ector County, TX

Ector County’s county-wide 381 agreement is an umbrella policy that promotes attraction, retention and expansion of quality employers and strategic investments in key reinvestment zones of the County.

Harris County, TX

Harris County Community Service Department assisted in the development of a 381 agreement with Exxon Mobil to accommodate an anticipated 10,000 new workers as a result of Exxon's new North American Headquarters. Harris County will provide $82 million in reimbursements to accommodate roads, parks and other infrastructure associated with Spring Wood Village master-planned community.

Harris County, TX

Harris County’s tax abatement program designates that projects in the target reinvestment zone qualify if they involve at least a $1 million investment in real property improvements and which create at least 25 new permanent jobs.

Memphis, TX

Memphis delivered a fifteen-year tax abatement (via Payment in Lieu of Taxes or PILOT) for $9.2 million for a local craft brewery to relocate and expand into a 43,000 sq ft facility. “Local breweries and taprooms can be catalytic to developing neighborhoods, attracting people and investment,” said Brett Roler, Downtown Memphis Commission vice president of planning and development.

Killeen, TX

Killeen City Council approved a ten-year $858,715 tax abatement deal with First National Bank in return for improvements to their existing property downtown. The investments would take the project from a single to five-story building. The city of Killeen has also established a tax abatement policy to spur revitalization in the downtown.

Port Arthur, TX

The First National Bank has deep ties to the city’s economic history; its co-founder, John Warner Gates, also founded the Texas Oil Company, better known as Texaco. In 2016 the building was repurposed for office and meeting space for the Port Arthur Economic Development Corporation and the Port Arthur Chamber of Commerce, bringing vibrancy back to downtown. After years of office use, the building’s grand spaces had been subdivided and its beautiful interior plaster work and murals were lost or obscured by dropped ceilings. In the rehabilitation, these inappropriate changes were stripped away to recreate the banking hall.

Nacodoches, TX

At its grand opening in 1955, the Hotel Fredonia drew a crowd of 6,000 onlookers, eager to tour what would quickly become the premier hotel and convention center in East Texas. Their hotel was the result of a community vision to increase the city’s tourism, economic vitality, and prestige by making it a travel destination. Construction of the Fredonia was supported through community fundraising: 1,100 local businesspeople invested in the project. Many decades after its heyday, the Fredonia had fallen on hard times: it closed in 1985, reopened a few years later, then shut its doors once more in 2013. The state and federal tax credit programs were instrumental in bringing the Fredonia—the largest and most storied building in Nacogdoches— back to life again. The Fredonia occupies a large complex at the edge of downtown Nacogdoches, and includes a ballroom and the city's Convention Center (at left of the image). The convention center is not historic and was not included in the tax credit project.

Baytown, TX

Baytown uses a portion of its Hotel/Occupancy Tax receipts to issue direct grants on a competitive basis to area culture and arts non-profits so long as they provide events and programs that generate tourism. They also support a tourism staff person that manages a Visitor Information Center.

Austin, TX

Visit Austin Foundation will offer funding to support students pursuing tourism related degrees at local institutions of higher learning; residents of all ages currently working in the hospitality and tourism industry wanting to advance their career through certification, continuing education or other professional development; and, organizations providing valuable workforce development in Austin’s hospitality and tourism sector.

Houston, TX

Several Texas Enterprize Zone designations have been made in the City of Houston. Most recently in June 2020, Powell Electrical Systems, Inc. was approved for the program—the company will add 10 jobs and retain 490 jobs.

Fort Worth, TX

Fort Worth nominated MillerCoors LLC for the program in a Texas Enterprize Zone in Tarrant County in order to enable the enterprise to invest $28 million in expanding their facilities.

Borough of Carlisle, PA

Borough of Carlisle, PA was experiencing deep economic challenges after the closing of three formerly manufacturing sites comprising over 60 acres. Using a range of local, state and federal funds and private investment the City was able to leverage over $150 million as of 2020 to revitalize former abandoned sites into thriving mixed-use places.

Robstown, TX

Until 2002, a rural 67.5-acre site that had been used for years for oil and gas exploration and had eight well sites across the property lay unused. After leveraging free assessment services from the Texas Railroad commission and brownfield remediation funds, the site was cleared in 2008. By 2017 the city was able to convert the land into a baseball stadium, fairgrounds, outlet mall and enhanced detention pond for water quality improvement.

Houston, TX

Developer Hines partnered with investment from Cresset-Diversified QOZ Fund to construct The Preston—a residential tower in Downtown Houston with 373 rental units. Because the project is located in an Opportunity Zone, the investors will be able to defer capital gains taxes.

San Antonio, TX

A Qualified Opportunity Fund purchased property on San Antonio’s South Side located in an Opportunity Zone; a 1,300-acre mixed-use climate-controlled self-storage facility and flex space for small businesses is now under construction, and the investor will be able to defer capital gains taxes on the investment.

Denton, TX

Serve Denton Center was funded using NMTC. It is a non-profit hub akin to a cowork space that offers affordable flex office spaces, community daycare services and a range of meeting and gathering spaces to members.

Memphis, TN

The revitalization and redevelopment of the historic Sears, Roebuck and Company Distribution Center into today’s Crosstown Concourse involved a financing stack spanning 30 funding sources including 22 federal programs, including New Markets Tax Credits. It is a marquee mixed use project for the city: the redevelopment into a LEED Platinum hub for education, cultural arts and mind, body, soul vendors, merchants and organizations.

Houston, TX

Houston’s East Downtown Management District’s manages a Tax Increment Reinvestment Zone initially funded infrastructure improvements that would create capacity on par with the high density, Central Business District located to the west across Interstate-59. As investments and redevelopment ensued, including the BBVA Compass Soccer stadium, increment value continued to be reinvested into walkable corridors that would connect sites within the district as well as connections to Downtown Houston’s George R. Brown Convention Center and other attractions. To ensure the area remained interesting and creative, District leaders cultivated relationships with area entrepreneurs, commercial real estate agents and real estate developers to draw small, local businesses and place them in interesting spaces and adapted reuse buildings and warehouses. Additional investments support place-making through murals, bikeways, public event sponsorships, parks and more.

East Aldine - Harris County, TX

The East Aldine Improvement District was created by the Texas Legislature in June 2001 to enhance the physical, social, and economic well-being of Aldine. It is a governmental entity administered by a nine-member, volunteer board of directors.

Justin, TX

Justin City Council passed an ordinance allowing the 4A EDC to fund all 4B eligible projects.

Magnolia, TX

Magnolia’s 4B corporation was able to attract Panda Biotech who invested $110 million in a new industrial hemp processing facility. As a token of good faith accompanying the move, Panda offered regional producers six tons of hemp seed to support local commodity crop production so long as they agree to voluntarily provide data to Texas A&M Agrilife Extension on crop performance.

Tomball, TX

Tomball's Type 4B EDC invests in the city’s Old Town district and in April 2020 purchased 6.2 acres of land within South Live Oak Industrial park for the purposes of adding a mixed-use development concept and preserving 40,000 square feet industrial stock due to high demand.

Bonham, TX

Bonham’s Type B corporation works in coordination with the City of Bonham to invest in public infrastructure and streetscapes to support redevelopment efforts in the downtown Bonham Historic District’s “Save Our Structures” Program. The program also provides matching funds to owners of private enterprises to assess structural improvements needed to remain or achieve code compliance.

Friendswood, TX

The City of Friendswood began collecting a new, one-eighth cent sales and use tax in January 2017 for economic development in downtown Friendswood. The seven-member Friendswood Downtown Economic Development Corp.—or FDEDC—was established to administer the funds that are accrued through a Type B sales tax.

The Neighborhood Recovery Community Development Corporation - Houston, TX

The Neighborhood Recovery Community Development Corporation (NRCDC) revitalizes communities with a holistic approach to economic development and investment. NRCDC operates throughout Houston, and has focused on the Third Ward since 1992. The Renaissance Center, a 100,000 square-foot retail center anchored by a grocery store, was developed by the community development corporation and has created over 375 jobs onsite, catalyzing significant economic investment within the area. NRCDC recently sold the Renaissance Center.

Community Ventures - Houston, TX

Community Ventures provides funds and capacity building assistance to non-profits in youth empowerment and workforce development programs across the state, including the maker-based youth education programs of TXRX Labs.

Dayton, TX

Dayton Community Development Corporation is a Type B economic development corporation whose mission is to promote the economic competitiveness of Dayton as well as the revitalization of the downtown. They manage a range of business incentive programs, small business loans, mural grants, façade improvement & code compliance grants, and play a key role in public-private partnership projects in a range of arenas.

Brazos Valley, TX

Community Loan Center of the Brazos Valley is a micro lender that allows for a safer alternative to high fee, high interest payday lenders for under-banked communities by offering small, low-cost loans to employers and their employees. They offer fair cash-flow solutions to businesses through flexible payday advances, automated payback programs, financial literacy and coaching, reduced fees and access to services after traditional banking hours.

Irving, TX

On The Road Lending in Irving, Texas makes affordable car loans, with a mission to remove transportation barriers for people seeking jobs, to help employees retain jobs, and to allow working families to live healthier lives.

Austin, TX

People Fund is a small business development center in Central Texas which also runs Capital Women and the Women’s Business Assistance Center, a catered set of business development services and discounted interest rates for women-owned enterprises seeking loans.

Houston, TX

Houston Business Development Inc has supported small business development through trainings, direct loans and on-site incubation in Southwest Houston for over thirty years. Their services and program offer a vital lifeline for early-stage small businesses and microenterprises in Houston.

Houston, TX

The Houston First Corporation is a local government corporation managing city-owned convention and performing arts facilities and parking structures. They partner with parks, performing arts centers, and other institutions to promote Houston as a great place to live, work, and visit. Organizations like Houston First can play a major role in stimulating the local economy and improving overall quality of life by leveraging tourism, cultural assets, and public events.

Stillwater, OK

Created the Stillwater Corridor Redevelopment Planwith a specific zoning district strategy to meet public goals and unlock private demand by allowing for more density in the corridor in between the campus and historic main street. They quite literally bridged the town gown divide by steering investment on the corridors that created the divide in the first place. City and campus were behind it specifically because it added a lot of off-campus housing and housing types for older students, researchers, and professional/teaching staff.

College Park, MD

In 2009, the University of Maryland worked to bridge the town-gown divide by forming partnerships with private foundations and the public sector to develop a more integrated campus edge that supported growth and investment in the surrounding neighborhoods. Through a joint planning initiative and the university’s facilities master plan, institutional investments have supported greater private investment in a historically marginalize and underserved community.

Austin, TX

ACC-Highland Mall Campus TOD – retrofitting older mall next to rail stop. Community college major anchor. Non-profit concentration. TAMU Bioscience incubator. Long-term, filling in the parking lot with a mixed-use walkable development but many phases. Precipitated the Leander campus model.

Detroit, MI

The City of Detroit understands the cultural value of public art and artistic expression, but requires a registry for property owners if they want graffiti or art to remain. They enforce the policy through blight ticketing or required removal.

New York, NY

The recession of the mid- to late-2000s lead to excessive amounts of retail vacancy along walkable corridors of Lower Manhattan leading to high costs to maintain empty spaces and a lack of safety and comfort for passersby. The Lower Manhattan Culture Council developed an artists-in-residency program called Swing Space to reduce vacancy and improve pedestrian experience while at the same time supporting ways that allow land owners to showcase and advertise the space to future long-term tenants.

Pearland, TX

On Wednesday, October 6, at the annual Texas Municipal League Conference, the City of Pearland was awarded Platinum Certification by Scenic Texas, the organization overseeing the Scenic City Certification Program. This program honors municipalities that uphold exceptional standards in enhancing scenic roadways and public spaces.

Management Districts

Action:

Management districts, special districts, and improvement districts are created through the Texas Legislature. Management districts empower commercial property owners to supplement City and County services and infrastructure. Property owners identify common problems and issues in their area and use their Management District to implement solutions.

Management Districts are used:

- To support economic activity in existing commercial centers

- To promote neighborhood revitalization

- To support raw land development

Management Districts may finance services and improvements through the levy of assessments on commercial property or ad valorem taxes. Some Management Districts are able to levy sales and use taxes or hotel occupancy taxes.

Created By:

State

Implement In:

City, County

4A Economic Development Corporation

Action:

Create a Type A Economic Development Corporation, funded through up to a half-cent of sales tax which operates to support primarily economic and industrial development projects such as manufacturing facilities, ports & aviation facilities, and infrastructure in support of such projects. 4A EDCs can also issue sales tax bonds.

Additionally, a Type A corporation may also fund or transfer funds in support of a Type B project under certain circumstances.

Local Development Code Chapters 501, 504 and 505 outline the characteristics and authorizations.

Created By:

State

Implement In:

City, County

4B Economic Development Corporation

Action:

Create a Type B Economic Development Corporation which operates to support economic and community development through a levee of up to one and half cents of sales tax. Type B EDCs can pay for land, buildings, equipment, facilities, and targeted infrastructure for a range of commercial or residential projects. Projects typically have a primary job generation requirement; however this can be waived for certain communities. They can also issue sales tax bonds.

Created By:

State

Implement In:

City, County

Community Development Corporation

Action:

Community Development Corporations are non-profit, community-based organizations focused on the revitalization of typically low-income, underserved neighborhoods. CDCs often deal with the development of affordable housing.

Created By:

Developer, Non-Profit

Implement In:

City, County

Examples:

Houston, TX (NRCDC)

Houston, TX (Community Ventures )

Dayton, TX

Resources:

Overview of Community Development Corporations

Texas Association of Community Development Corporations

Community Development Financial Institution

Action:

Community Development Financial Institutions are dedicated to affordable lending to help low-income, low-wealth, and otherwise economically disadvantaged communities to improve economic and social outcomes. CDFIs can be credit unions, loan finds, microloan funds, banks, or venture capital providers. Certified CDFIs receive federal funding through the Community Development Financial Institution Fund.

Created By:

Developer, Non-Profit

Implement In:

City, County

Small Business Development Corporation

Action:

Small Business Development Corporations provide free or low-cost counseling, skills training, and supportive services to small business owners and entrepreneurs. They assist them in creating, growing or innovating their business models from creation to exit. Their courses and programs include drafting business plans, connection to mentors, understanding compliance with public and industry codes and standards, and preparing for loan applications—which are typically SBA 504 loans. They can also provide specialized courses or workshops on-demand at the request of businesses or other partners.

Created By:

Non-profits, City, County

Implement In:

City, County

Non-Profit Institutional Employers

Action:

Often referred to as anchor institutions, non-profit institutional employers are defined as sizable entities with large physical, cultural and economic ties to the community, such as academic institutions, medical centers or hospitals. Their substantial land holdings, large capital investments, status as an employer in stable or anticyclical industries, and mission-driven business models offer many opportunities for alignment on public investment priorities.

Created By:

Developer, Non-Profit

Implement In:

City, County