On This Page

Accelerate Pre-Development Process

Streamlined or Expedited Permitting

Action:

Streamline permitting process to promote commercial or mixed-use development. Using strategic planning local governments and economic development organizations can designate that a specific project or certain types of land uses receive priority approvals and be set on an expedited track relative to other standard permits or residential.

Align multiple departments within a city responsible for approving a particular development project. An expedited permitted process reduces developer cost at low or no cost to the local jurisdiction.

Created By:

City, County, Economic Development Corporation

Implement In:

City, County

Public Property Sale or Land Grant

Action:

Leverage publicly- or entity-owned land to steer development practices in alignment with a desired mix. Invest in pre-entitlement or sell public properties at minimal cost to developers with the stipulation that a desired mix of uses are to be constructed on the lot within a specified time period. Texas Local Government Code Chapter 373, Community Development in Municipalities, allows for public property sales.

Created By:

City, County, Special District, Economic Development Organization

Implement In:

City, County

Adaptive Reuse

Action:

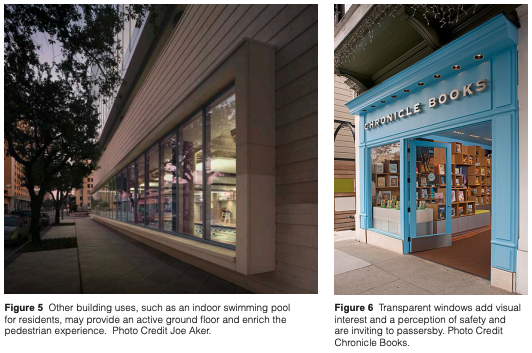

Promote and invest in the adaptive reuse and repurposing of existing old or historic properties. Historic buildings represent the community’s past, cultural heritage, and the millions of dollars of infrastructure investment to activate the site. Keeping properties in service ensures that they will contribute to city revenues which can then be used to protect the community’s investment in the infrastructure of older neighborhoods.

Often the cost of revitalizing an older building may be higher than demolition and new construction, so the role of the public sector partner can be to offset costs for redevelopment in other ways such as:

- Acquiring the property,

- Investing in infrastructure connected to the property,

- Leveraging funds to remove hazards or contamination to prepare the site for redevelopment,

- Rezoning, changing permitted uses,

- Planning and approving a development concept and bidding out the project, or

- Committing funds to a portion of the project that will be for public use.

Created By:

City, County, Special District, Developer, Non-Profit

Implement In:

City, County

Flexible Incentive Tools for Local Governments

Tax Increment Reinvestment Zone (TIRZ) or Tax Increment Finance (TIF) Districts

Action:

Create a political subdivision to eliminate blight, encourage commercial and residential development, and improve overall quality of life for residents or businesses to support a specific program, project or neighborhood. The subdivision does not create a new tax but instead establishes a “base tax value” for a designated zone. Once that base tax value is established, additional ad valorem property taxes can only be used for infrastructure, facade programs, or any type of public improvement to the zone. A TIRZ can be created by a City or County or can be established through a petition signed by property owners who own at least 50% of the appraised value of property in the area (a "petition" TIRZ).

Created By:

State

Implement In:

City, County

380 Agreements

Action:

Allow reimbursement to developers for infrastructure improvements up to an agreed-upon amount to stimulate desired development in urban areas. Chapter 380 of the Local Government Code authorizes municipalities to offer incentives designed to promote economic development, such as commercial and retail projects. Specifically, it provides for offering loans and grants of city funds or services to developers at little or no cost to promote state and local economic development and to stimulate business and commercial activity. To provide a grant or loan, a City must establish a program to implement the incentives. Before proceeding, Cities must review their City charters or local policies that may restrict a City's ability provide a loan or grant.

Created By:

City

Implement In:

City

381 Agreements

Action:

Allow reimbursement to developers for infrastructure improvements up to an agreed-upon amount to stimulate desired development in rural areas. Chapter 381 of the Local Government Code allows Counties to provide incentives encouraging developers to build in their jurisdictions. A County may administer and develop a program to make loans and grants of public money to promote state or local economic development and to stimulate, encourage, and develop business location and commercial activity in the county. The County may develop and administer a program for entering into a tax abatement agreement. This tool allows Counties to negotiate directly with developers and businesses.

Created By:

County

Implement In:

County

Tax Abatements

Action:

Allow tax abatement to developers for residential, commercial, or industrial projects within designated reinvestment zones. A tax abatement is an agreement between a local government and a property owner to partially exempt them from part of the taxes owed on a property in return for improvements to the property. Abatements are governed by Tax Code, Chapter 312. Local taxing units can use abatements to attract development to their jurisdictions.

Created By:

City, County, EDC, School District, Special District

Implement In:

City, County

State Historic Preservation Tax Credit

Action:

Identify historic properties and assist in application for tax credit through the Texas Historic Preservation Tax Credit Program established in 2015. Credit is worth 25% of eligible rehabilitation costs and is available for buildings listed in the National Register of Historic Places, as well as Recorded Texas Historic Landmarks and Texas State Antiquities Landmarks. May be combined with Federal Historic Preservation Tax.

Created By:

State

Implement In:

City, County

Hotel Occupancy Taxes

Action:

Opt into your localities ability to levee a hotel occupancy tax on nightly stays in your area to fund projects that may drive tourism or could create a venue for hosting events. Texas Local Tax Code Chapter 351, the state and local governments can impose an occupancy tax on nightly hotel and lodging stays (including short term rentals through AirBnb or HomeAway) of up to 9% of the price of a hotel room. Local HOT can be managed directly by the city or county but must be used for the purposes of driving tourism. Cities of under 35,000 can also levy a HOT in their extraterritorial jurisdiction (ETJ). So long as the project directly promotes tourism, it is eligible; therefore HOT funds can be used to fund arts facilities, historic preservation efforts, marketing & promotion expenses, wayfinding & signage, sports facilities, meeting & events spaces, and transportation options for tourists.

Created By:

City, County

Implement In:

City, County, State

Promote Needs-Based Development Tools

Texas Enterprise Zones

Action:

The Enterprise Zone Program offers state and local tax benefits of up to $7,000 per job in economically distressed areas. Benefits include Sales & Use Tax Refunds and Franchise Tax reductions, abatements or credits.

Approved projects in Enterprise Zones must commit to create or retain permanent jobs, make capital investment in the zone, fill at least 25 percent of its new jobs with individuals who are economically disadvantaged or residents within the zone, and maintain an agreed upon number of jobs for at least three years.

Created By:

State

Implement In:

City, County

Examples:

Resources:

Remediate & Redevelop Brownfields

Action:

Remediate, reinvest in and reuse abandoned, underutilized or stigmatized properties to protect the environment, reduce blight and open up redevelopment opportunities.

A brownfield is any site or property that’s reuse potential is hindered by the presence or potential presence of contamination.

Created By:

City, County

Implement In:

City, County

Opportunity Zones

Action:

Assess and market feasible Opportunity Zone investment projects in eligible census tracts. to public and private partners. Opportunity Zones were enacted by the Tax Cuts and Jobs Act of 2017 and are designed to incentivize private investment in projects that create economic opportunities or generate jobs in designated distressed census tracts. The program allows private investors to invest in projects within these tracts and defer or forgo capital gains taxes on earnings from the project, or sale of interest exchanged after project completion, for up to ten years so long as the funds are continually reinvested in a Qualified Opportunity Fund.

Created By:

US Congress

Implement In:

City, County

New Markets Tax Credits

Action:

The New Markets Tax Credit (NMTC) Program, enacted by Congress as part of the Community Renewal Tax Relief Act of 2000, is incorporated as section 45D of the Internal Revenue Code. This Code section permits individual and corporate taxpayers to receive a credit against federal income taxes for making Qualified Equity Investments (QEIs) in qualified community development entities (CDEs).

These investments are expected to result in the creation of jobs and material improvement in the lives of residents of low-income communities through investments specifically in commercial enterprises or commercial real estate. Examples of expected projects include financing small businesses, improving community facilities such as daycare centers, and increasing home ownership opportunities. Credits are only applied if the investment interest remains in the project for seven years.

Created By:

US Congress

Implement In:

City, County

Examples:

Resources:

US Department of Treasury

New Market Tax Credit Coalition

Primer from BizJournal